Investors will also watch macro-economic data and earnings for the March quarter. The consumer price inflation and index of industrial production data are due later today

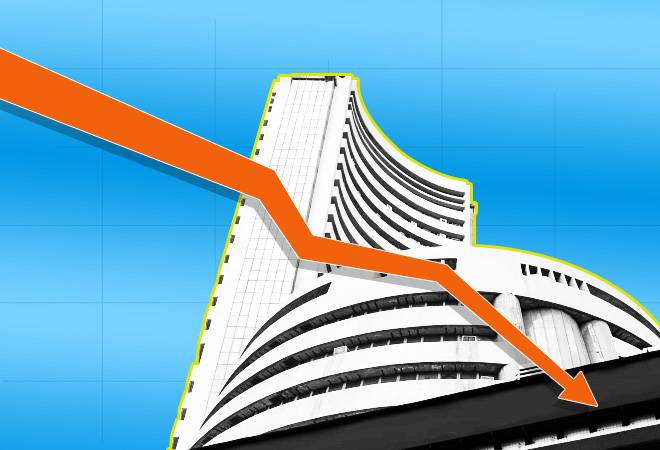

Indian markets on Monday opened nearly 2.4% amid likely a complete lockdown in Maharashtra and more states imposing localised curbs as covid-19 cases continued to surge.

At 9.40 am, the benchmark Sensex fell 2.42% or 1300 points to 48,290 points while Nifty dropped 2.7% or 396 points to 14,438 points.

The Maharashtra government will meet on Wednesday to give its nod for imposition of lockdown. The state government will decide whether it will be imposed for eight, 15 or 21 days.

On Sunday, Maharashtra reported over 63,000 new infections, with India reporting more than 1.72 lakh covid cases, as total active cases topped over 1.1 million.

Investors will also watch macro-economic data and earnings for the March quarter. The consumer price inflation and index of industrial production data are due later today.

CPI will be at 5.4% in March against 5.03% a month ago, while IIP will be at -3% in February versus -1.6% a month ago.

Beside these events, vaccine drive and global cues will also be watched closely.

"Since the second wave of the pandemic is turning out worse than expected, there is profound uncertainty about its impact on the economy and markets. Since the situation is the worst in economically significant Maharashtra, this can impact the market's assumption of around 11% GDP growth & above 30% earnings growth".

"The situation may improve if cases peak soon and start coming down. But presently, this is a negative. The bad health situation and INR depreciation have improved prospects for the pharma & IT sectors, which are likely to remain resilient even during a market downturn. Economy-facing stocks are likely to be under pressure,".

Banking stocks fell the most on Monday. RBL Bank slumped 8%, Indusind Bank dropped 7.7%, Federal Bank by 6%, State Bank of India by 5%, Bandhan Bank was down 4.8%, Kotak Mahindra Bank by 3.7%, ICICI Bank by 3.5%, and Axis Bank slumped 3.2%.

"The continued weakness in banking stocks, due to increased fear of a spike in NPAs, is limiting upside despite the strong performance from the other sectoral pack so the alignment between the benchmark and banking index is critical else the consolidation will continue. Amid all, we reiterate our cautious view and suggest traders preferring hedged bets,".

Get watch our process Click here Ideal Stock Investment , daliy call profit, Market News, Fill Our ask an Expert form

For Ask An Expert Advice Give A Missed Call On - 0731-4994956